How The SECURE Act Affects Your Retirement?

The Setting Every Community Up for Retirement Enhancement Act (SECURE) got approved by the government in December 2019. The bill comes with major provisions that aim at increasing access to tax-advantaged accounts. The Act is here to help all of us Americans to have a better post-retirement life.

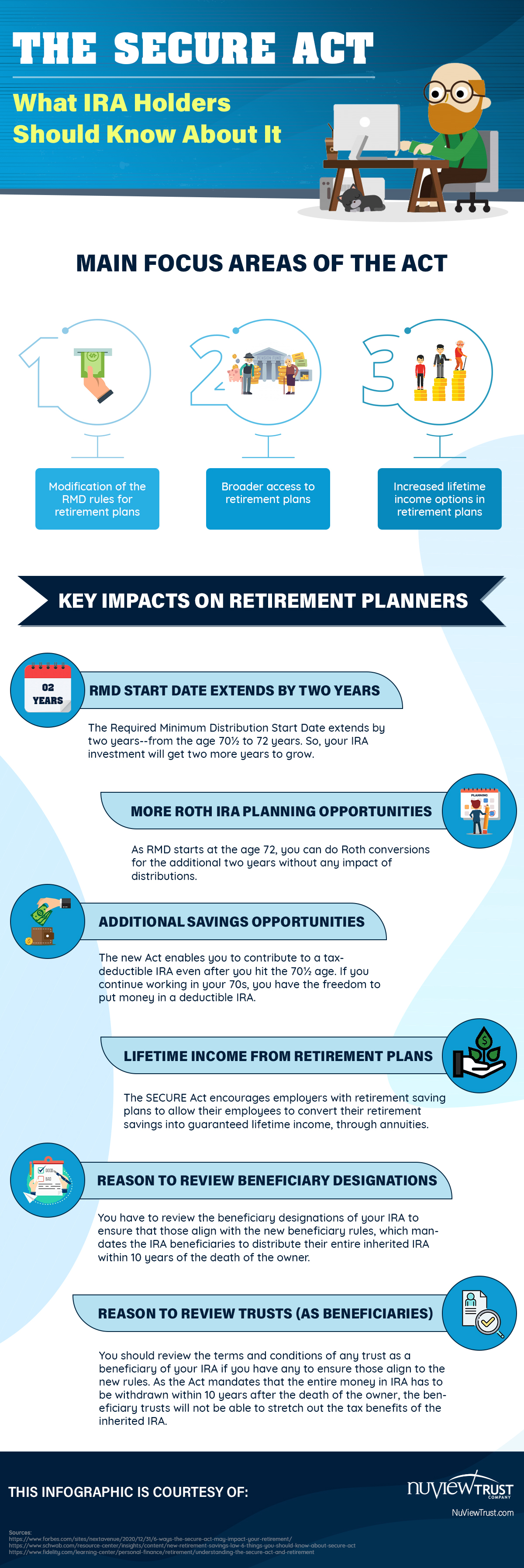

Significant provisions of the SECURE Act

• It pushes back the age at which you need to take required minimum distributions or RMD. Earlier the age at which you would make your first withdrawal was 70½, which has now shifted to 72. However, you can keep contributing indefinitely.

• The Act also has a provision for non-spouses who inherit the IRAs. The new rule requires them to make RMDs in such a way that ends up emptying your account in 10 years.

Impact of the Act on your retirement

The Act has a significant impact on the retirement accounts like IRAs and 401(k)s, as mentioned below.

• Inherited IRAs: If you inherited a retirement plan like an IRA or 401(k) as a non-spouse beneficiary, then as per the old rule, you were able to withdraw from the account for the rest of your life. But, under the new Act, you have to empty the account within ten years. It means you have to pay taxes sooner.

• IRA contributions: As per old rules, you were able to contribute to your retirement account under age 70½. But, the SECURE Act enables you to keep contributing regardless of your age. The only requirement is you need to demonstrate a source of regular income.

In short

Those were some significant provisions of the SECURE Act and their effect on your IRAs. The Act has pushed the age limit for making RMDs from 70½ to 72 years. It can benefit you because now you have more time to make savings.

The SECURE Act Affects Your Retirement

Leave a reply

You must be logged in to post a comment.